Next-generation methods that streamline biosimilar expression and characterization are imperative to lowering the cost of development and maximizing market growth.

Biosimilars have delivered on their promise to cut costs, increase access, and improve patient lives. As highly similar successors to commercially-available biologics, they have transformed patient outcomes in the last several decades by treating diseases with increased precision and specificity compared to conventional small-molecule drugs. Biosimilars have significantly contributed to patient care and drug accessibility, but their benefits have yet to be maximized.

While many challenges remain, the overarching focus remains on lowering the costs of biosimilar development and manufacturing. In this blog post, we examine the challenges, opportunities, and trends for biosimilars in the coming years. In addition, we discuss the impact of innovative technologies on biosimilar development, including data from our latest application note, where we used Alto™ Digital SPR to successfully characterize biosimilars derived from PlantForm’s vivoXPRESS® technology, demonstrating its ability to streamline the acquisition of high-quality data and its relevance to the future of biosimilars.

Table of contents

- What are biosimilars?

- Future of biosimilars: challenges and opportunities

- Emerging technologies for biosimilar development

- Conclusion

What are biosimilars?

Omnitrope was approved by the EMA in 2006 as the world’s first biosimilar medicine, a biosimilar for recombinant human growth hormone.1 The FDA approved its first monoclonal antibody biosimilar in 2016 with the approval of Inflectra.2 These advancements led the way for several other biosimilar products to be approved worldwide as successors to their original innovator drug over the last 20 years. As defined by the FDA, a biosimilar is “a biologic that is highly similar to and has no clinically meaningful differences in terms of safety, purity, and potency (safety and effectiveness) from an existing FDA-approved biologic, called a reference product.”3 Biosimilars offer a more cost-efficient and equally effective alternative to their reference products, thereby increasing accessibility to biologic therapies and improving patient outcomes.

To increase available treatment options, regulatory bodies have a recognized abbreviated process for approving biosimilars.4,5 While pioneer biologics require comprehensive data on safety and efficacy, biosimilars only require data on clinical equivalence to the reference biologic, as well as data on interchangeability if the designation is sought by the manufacturer.4-6 This enables developers to cut down the cost and time required for production.

Since their introduction, biosimilars have largely broadened and accelerated patient access to innovative therapies, while allowing for the reallocation of funding towards other healthcare initiatives.7-9 However, with only 40 biosimilars approved by the FDA as of December 2022, and even fewer being available on the market, their full potential have yet to be maximized.2

Future of biosimilars: Challenges and opportunities

The future of biosimilars is promising, as they have the potential to benefit patients by increasing access to important biologic therapies at a lower cost. To reach this future, biosimilar manufacturers must address several challenges, including:

- Long expression times: Current biosimilar production methods, such as generation of stable cell lines for optimized expression of biosimilars, can take up to six months.

- High cost of production: Despite considerable cost-savings compared to reference biologics, biosimilars remain costly to develop, requiring an average of $100-$200 M per drug.10 As clinical trials account for over 50-75% of that budget, the focus must remain on streamlining the drug development and manufacturing phases to cut down costs.11-12

- Long time to market: Biosimilars require an average of 8-10 years to bring to market.10 Decreasing time to market would not only translate to significant cost-savings for biosimilar manufacturers but also present a significant advantage for market penetration.11

- Challenging to characterize: Bioassays commonly used for characterization and quality control, such as enzyme-linked immunosorbent assays (ELISAs) and fluorescence-based assays, provide limited end-point data while consuming large volumes of sample and requiring significant hands-on time.

Despite these challenges, positive developments in the biosimilar market are driving its projected growth to over $100B USD by 2030, compared to $30B USD in 2021.13 This presents significant opportunities for biosimilar manufacturers and important implications for patients. Some of these positive trends include:

- Looming patent cliff: Patents for over 190 biologics from top pharma companies are set to expire by 2030, with an expected loss of over $230B.14 The increasing competition is set to drive down costs for biosimilars and originator products alike, further increasing accessibility for patients.

- Evolving regulatory framework: Regulatory agencies have established abbreviated approval processes and continue to introduce changes to support the adoption of biosimilars.1,4,5,15,16 Some of the most recent and impending changes include biosimilar switching strategies and waiving of confirmatory Phase III efficacy trials.15-18

- Emerging technologies: As advancements are made in biosimilar manufacturing, producing these therapies is becoming easier and more cost-effective, further driving down costs and increasing accessibility for patients.

Emerging technologies for biosimilar development

New technologies that streamline biosimilar characterization early in the pipeline could have important implications for incentivizing innovation, decreasing end-user costs, and increasing accessibility. Manufacturers seeking to bring biosimilars to market can gain an advantage by leveraging these tools to improve on existing practices. Companies such as PlantForm and Nicoya are paving the way for streamlined biosimilar development with their next-generation platforms.

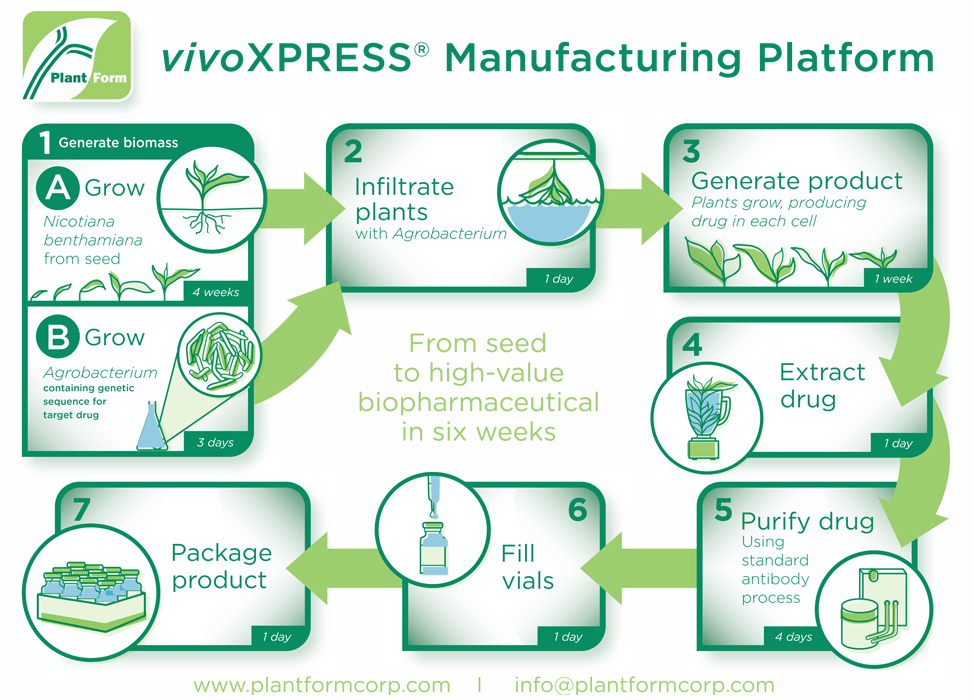

PlantForm’s vivoXPRESS® is a proprietary technology that uses genetically modified plant Nicotiana benthamiana to develop and manufacture high-value protein and antibody drugs with minimized costs and production time. The process from seed to high-value pharmaceuticals is completed within six weeks (refer to Figure 1) and presents several other advantages compared to conventional biomanufacturing methods, including scalability, transferability, and minimized costs.19

VivoXPRESS® is currently accelerating the development of biosimilars for Lucentis® (ranibizumab) and Keytruda® (pembrolizumab), expected to be market ready by 2027 and 2028, respectively. The streamlined manufacturing process generates biosimilars at 10% of the cost of mammalian cell fermentation technology and at 12.5% to 25% of the cost of bacterial fermentation. VivoXPRESS® also reduces the production time to generate stable, optimized expression of biosimilars from up to six months to just six weeks. In addition, the process has already been successfully scaled and transferred to several different contract manufacturing organizations (CMOs).

Of the many techniques used to characterize and validate biosimilars, ligand binding assays (LBAs) are one of the most critical. LBAs are used to assess biosimilarity, validate the development process, and enforce quality control. As well, these assays are used to compare the biosimilar to the original drug by characterizing ligand binding to its target molecule to demonstrate functional similarity.

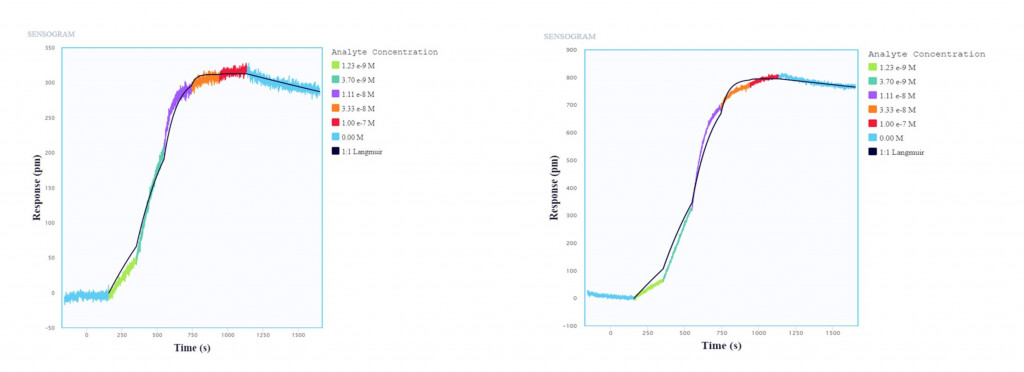

Nicoya’s Alto, the world’s first digital microfluidics-powered (DMF) SPR platform, is well-positioned for conducting LBAs. As a label-free, real-time, and automated platform, LBAs performed on Alto require just a fraction of the hands-on time and sample volume compared to conventional techniques, minimizing the cost of production and time to market of biosimilars. To demonstrate the benefits of VivoXPRESS® and Alto in biosimilar development, we collaborated with PlantForm to successfully conduct proof-of-concept LBAs using Keytruda® and pembrolizumab (Figure 2), with the results summarized in our latest application note.

Nicoya’s Alto and PlantForm’s vivoXPRESS® technologies streamline the development and manufacturing of biosimilars, presenting the significant cost and time-savings required for success in a growing biosimilar market.

Conclusion

The biosimilar market is projected to boom over the next decade as an unprecedented number of biologics patents are set to expire, presenting a significant market opportunity for biosimilar manufacturers and important implications for patient care. Given the complexity and cost of developing and manufacturing biological drugs, innovative players have an edge in bringing their products to market and fulfilling the growing demand. PlantForm’s vivoXPRESS® technology has already been successfully scaled and transferred to multiple CMOs, and is currently being leveraged to accelerate the development of biosimilars for Lucentis® (ranibizumab) and Keytruda® (pembrolizumab), expected to be market ready by 2027 and 2028, respectively. Alto provides high-quality data while reducing time to answer, proving its capability to streamline LBAs that are critical to the development and manufacturing of biosimilars. Combined, these cutting-edge technologies are uniquely positioned to support the development of a strong biosimilar pipeline in the coming years.

Ready to accelerate your biosimilar pipeline with Alto? Chat with us today.

References

- Schiestl M, Zabransky M, Sörgel F. Ten years of biosimilars in Europe: Development and evolution of the regulatory pathways. Drug Des Devel Ther. 2017;11:1509-1515. doi: 10.2147/DDDT.S130318

- Biosimilar Product Information. U.S. Food and Drug Administration. Updated December 19, 2022. Accessed February 23, 2023. https://www.fda.gov/drugs/biosimilars/biosimilar-product-information

- Review and Approval. U.S. Food and Drug Administration. Updated December 13, 2022. Accessed January 18, 2023. https://www.fda.gov/drugs/biosimilars/review-and-approval

- Implementation of the biologics price competition and innovation act of 2009. U.S. Food and Drug Administration. Updated February 12, 2016. Accessed January 18, 2023. https://www.fda.gov/drugs/guidance-compliance-regulatory-information/implementation-biologics-price-competition-and-innovation-act-2009

- Biosimilar biologic drugs in Canada: Fact sheet. Health Canada. Updated August 27, 2019. Accessed January 18, 2023. https://www.canada.ca/en/health-canada/services/drugs-health-products/biologics-radiopharmaceuticals-genetic-therapies/applications-submissions/guidance-documents/fact-sheet-biosimilars.html

- Biosimilar and interchangeable biologics: More treatment choices. U.S. Food and Drug Administration. Updated October 12, 2021. Accessed January 18, 2023. https://www.fda.gov/consumers/consumer-updates/biosimilar-and-interchangeable-biologics-more-treatment-choices

- Association for Accessible Medicines. The U.S. generic and biosimilar medicines savings report. Published September 2022. Accessed January 30, 2023. https://accessiblemeds.org/sites/default/files/2022-09/AAM-2022-Generic-Biosimilar-Medicines-Savings-Report.pdf

- EU pharmaceutical legislation reform critical to sustain biosimilar medicines competition for the future. Medicines for Europe. Published October 6, 2022. Accessed February 22, 2023. https://www.medicinesforeurope.com/wp-content/uploads/2022/10/20221006-Press-Release-Bios22.pdf

- Saskatchewan launches biosimilars initiative. Government of Saskatchewan. Published October 20, 2022. Accessed February 27, 2023. https://www.saskatchewan.ca/government/news-and-media/2022/october/20/saskatchewan-launches-biosimilars-initiative

- Halimi V, Daci A, Netkovska KA, Suturkova L, Babar ZUD, Grozdanova A. Clinical and regulatory concerns of biosimilars: A review of literature. Int J Environ Res Public Health. 2020;17(16):5800. doi: 10.3390/ijerph17165800

- Chen Y, Monnard A, da Silva JS. An inflection point for biosimilars. McKinsey & Company. Published June 7, 2021. Accessed January 27, 2023. https://www.mckinsey.com/industries/life-sciences/our-insights/an-inflection-point-for-biosimilars

- Chen Y, Dikan J, Heller J, da Silva JS. Five things to know about biosimilars right now. McKinsey & Company. Published July 17, 2018. Accessed January 27, 2023. https://www.mckinsey.com/industries/life-sciences/our-insights/five-things-to-know-about-biosimilars-right-now

- Global Market Insights Inc. Biosimilars Market size to exceed $100bn by 2030. Published June 2022. Accessed January 18, 2023. https://www.gminsights.com/pressrelease/biosimilars-market

- Dutton G. Looming patent cliff will be pharma’s moment of truth. BioSpace. Published June 7, 2022. Accessed January 18, 2023. https://www.biospace.com/article/looming-patent-cliff-will-be-pharma-s-moment-of-truth/

- Canada’s evolving market for biosimilars and what it means for payers. Government of Canada Patented Medicine Prices Review Board. Updated May 16, 2022. Accessed February 14, 2023. https://www.canada.ca/en/patented-medicine-prices-review/services/npduis/analytical-studies/posters/evolving-market-biosimilars-payers.html

- Statement on the scientific rationale supporting interchangeability of biosimilar medicines in the EU. European Medicines Agency, Heads of Medicines Agency. Published September 19, 2022. Accessed February 14, 2023. https://www.ema.europa.eu/en/documents/public-statement/statement-scientific-rationale-supporting-interchangeability-biosimilar-medicines-eu_en.pdf

- Jensen H, Miller A. News release: Ontario expanding safe use of biosimilars. Published December 20, 2022. Accessed February 27, 2023. https://news.ontario.ca/en/release/1002611/ontario-expanding-safe-use-of-biosimilars

- Consultation outcome: MHRA draft guidance on the licensing of biosimilar products. Medicines and Healthcare products Regulatory Agency. Updated May 10, 2021. Accessed February 22, 2023. https://www.gov.uk/government/consultations/mhra-draft-guidance-on-the-licensing-of-biosimilar-products

- Manufacturing process diagram. PlantForm Corporation. Updated June 2, 2016. Accessed February 27, 2023. https://www.plantformcorp.com/diagram.aspx